Introduction to Volatility Cones

Volatility is a fundamental aspect of stock price movements and greatly impacts trading risk and strategy. Understanding whether the market or a particular stock is experiencing unusually high or low volatility can help traders make more informed decisions about position size, entry timing, and stop management.

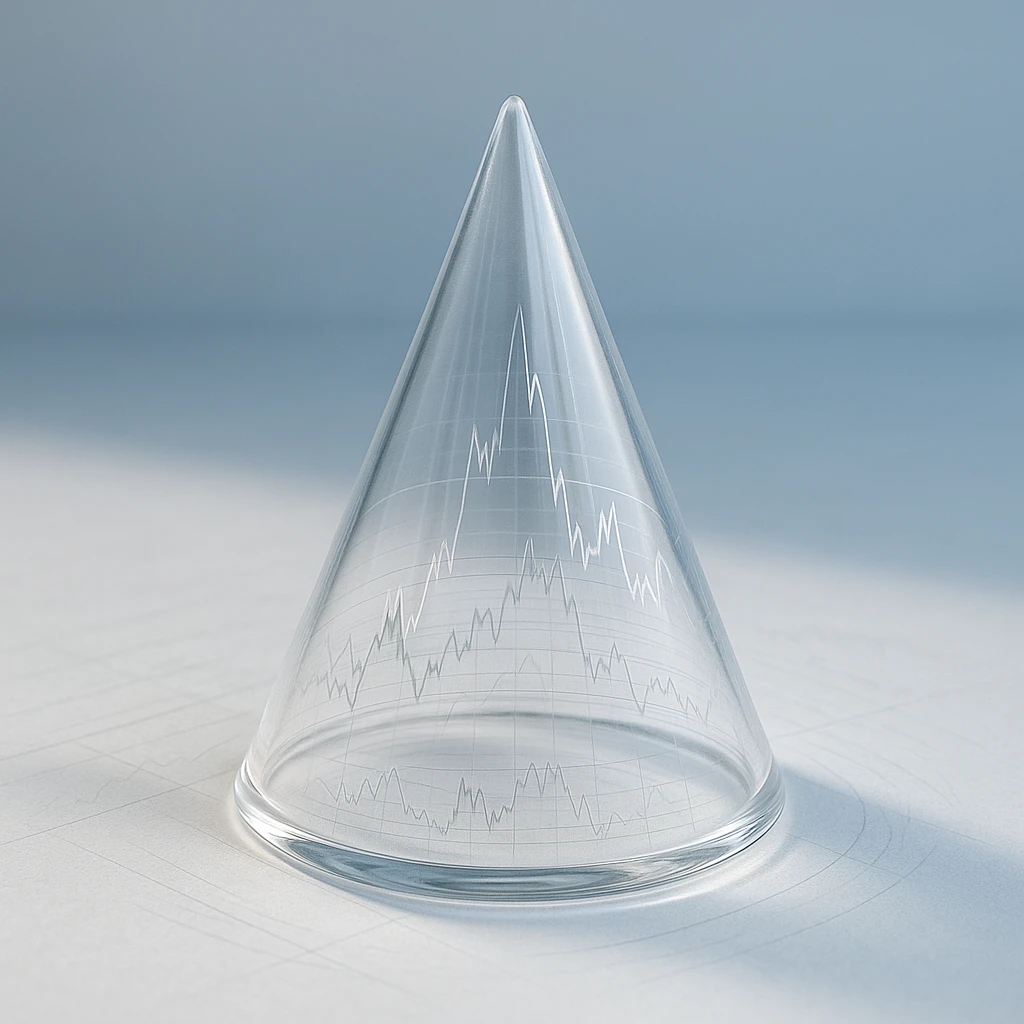

A volatility cone is a chart-based tool that displays the historical range of volatility values over different time frames and percentiles. This 'cone' visually frames current volatility within a historical context, helping traders judge if volatility is elevated or subdued relative to past behavior.

What Is a Volatility Cone?

A volatility cone shows the distribution of historical volatility calculations over various time horizons (e.g., 5, 10, 20, 30 days). It presents key percentiles (often the 10th, 25th, median, 75th, and 90th percentiles) for each time frame, allowing you to see how volatile a stock typically has been historically.

The visual resembles a cone because volatilities tend to increase with longer time periods, and the percentile bands outline a funnel within which volatility usually falls.

Why Use Volatility Cones?

- Contextualize Current Volatility: Is today’s volatility typical, high, or low compared to history?

- Risk Adjustment: Adapt your trade size and stop-loss placement according to current volatility levels.

- Strategy Selection: Decide if momentum strategies or mean-reversion approaches may work better given prevailing volatility.

- Volatility Forecasting: Infer potential future moves based on historical volatility patterns.

Step-by-Step: How to Build a Volatility Cone

You can construct a volatility cone yourself using historical price data and simple calculations.

- Choose Your Stock and Data Range: Obtain daily closing prices for at least 1-2 years.

- Calculate Historical Returns: Compute daily returns as the percentage change from one close to the next.

- Calculate Rolling Volatility:

- Pick rolling windows such as 5, 10, 20, 30 days.

- For each day, compute the standard deviation of returns over the past n days.

- Annualize volatility by multiplying by the square root of 252 (trading days per year).

- Aggregate Percentiles:

- For each window length, calculate the 10th, 25th, 50th (median), 75th, and 90th percentiles of the rolling volatilities.

- Plot the Volatility Cone: Plot percentile values on the y-axis and window lengths on the x-axis to visualize the range of historical volatility.

Many charting platforms and spreadsheet software enable calculation and plotting of percentile bands easily.

Interpreting Volatility Cones: Practical Application

Once you have a volatility cone for your chosen stock, you can compare the current realized or implied volatility to the historical bands:

- Volatility Within Median Range: Market risk is typical; maintain your usual sizing and stops.

- Volatility Near Upper Bands: Stock is more volatile than usual; consider reducing position size and widening stops.

- Volatility Near Lower Bands: Volatility is unusually low; you might increase position size but keep stops tighter due to potential for breakout moves.

Using volatility cones supports dynamic risk management rather than a static approach which assumes consistent volatility.

Worked Example: Applying a Volatility Cone in Trade Planning

Context: You want to trade the stock XYZ. After building its volatility cone using 1 year of data, you observe:

| Window (Days) | 10th Percentile (%) | Median (%) | 90th Percentile (%) |

|---|---|---|---|

| 5 | 12 | 18 | 26 |

| 10 | 10 | 15 | 22 |

| 20 | 8 | 13 | 18 |

| 30 | 7 | 11 | 16 |

Current 10-day volatility: 26%

Current volatility is above the 90th percentile historically, signaling unusually high recent price swings.

Trade Adjustment:

- Reduce position size to 50% of normal to protect capital against large swings.

- Set stop-loss wider than usual, for example 2.5 times the average true range (ATR) rather than 2 times, acknowledging elevated volatility.

- Be cautious about entering new trades until volatility stabilizes unless volatility-based strategies are used.

After several days, if volatility drops back to the median 15%, adjust risk management parameters accordingly.

Checklist: Using Volatility Cones in Your Trading Routine

- Obtain and update your volatility cones regularly (e.g., monthly or quarterly).

- Calculate rolling volatilities at key windows relevant to your trading horizon.

- Compare current volatility metrics to historical percentile bands.

- Adjust your position sizing based on whether volatility is elevated, normal, or low.

- Modify stop-loss and take-profit levels according to volatility context.

- Revise your strategy (e.g., favor momentum or mean reversion) based on volatility regime.

- Document volatility readings and adjustments in your trade journal for review.

Common Mistakes When Using Volatility Cones

- Ignoring Volatility Changes: Applying fixed stops and position sizes regardless of volatility leads to unbalanced risk exposure.

- Using Too Short or Inconsistent Data: Building cones with insufficient data or changing parameters frequently reduces reliability.

- Overreacting to Volatility Spikes: Temporary volatility bursts can skew cones; consider smoothing or confirming with additional indicators.

- Mistaking Historical for Predictive: Volatility cones describe past behavior, not guaranteed future patterns; always combine with other analysis.

- Not Annualizing Volatility Properly: Comparing volatility across periods without consistent scaling can mislead conclusions.

Practice Plan: 7-Day Mini Exercises to Get Hands-On with Volatility Cones

- Day 1: Download daily price data for a liquid stock over the past 2 years.

- Day 2: Calculate daily returns and begin calculating 5-day rolling volatilities.

- Day 3: Expand rolling volatility calculations to 10, 20, and 30-day windows.

- Day 4: Compute percentile values (10th, 25th, 50th, 75th, 90th) for each window.

- Day 5: Plot the volatility cone with all percentile bands and timeframes.

- Day 6: Identify current volatility for that stock and locate it on the cone to assess context.

- Day 7: Review recent trades or hypothetical trades to adjust position sizes and stops based on what the cone indicates.

Summary and Final Thoughts

Volatility cones provide a systematic way to place current volatility into historical context, thereby supporting better risk management and adaptive trading decisions. They help you avoid the pitfalls of fixed position sizing and static stops, which can lead to outsized losses or missed opportunities during changing market volatility regimes.

By practicing building and interpreting volatility cones regularly, you will develop a nuanced approach to calibrating your trades according to the true risk environment rather than intuition alone.