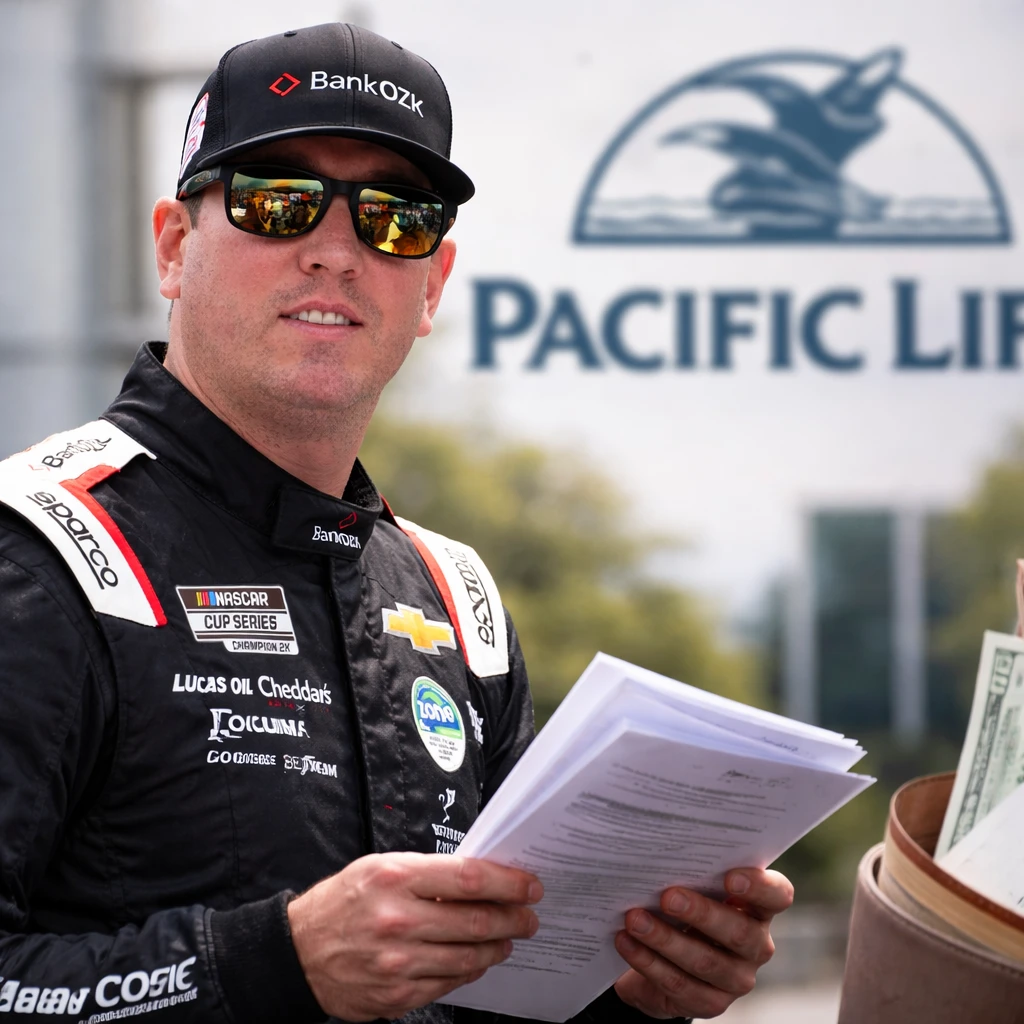

On Thursday, Pacific Life Insurance Company submitted a request to a federal court in the Western District of North Carolina to dismiss an $8.5 million lawsuit filed by two-time NASCAR champion Kyle Busch and his wife. The couple's lawsuit contends that Pacific Life sold them Indexed Universal Life (IUL) insurance policies under false and negligent representations, portraying these policies as tax-free income sources for retirement.

The case involves five distinct IUL policies that the Buschs purchased from 2018 through 2022. These policies were intended to provide in excess of $90 million in insurance coverage to the racing champion and were designed to offer both an immediate death benefit and the prospect of accumulating cash value over the long term if maintained accordingly.

Pacific Life responded by asserting that Kyle Busch did not fully fund the policies as planned. The insurer noted that some policies were allowed to lapse while others were surrendered prematurely. Busch argues that he lost $10.4 million and brought the complaint last October, claiming the company failed to disclose the true risks embedded in the IUL products.

In its motion to dismiss, Pacific Life highlighted that both Kyle and his wife signed numerous documents confirming their comprehension of the policy structure. Among these documents was an agreement that indicated they would pay the scheduled premiums consistently and maintain the policies for a period of 30 years, extending through age 70 and beyond.

The insurer's filing pointed out that instead of sustaining payments to capitalize on the policies’ growth potential, the plaintiffs failed to make their premium payments on time, neglected to monitor the allocation of their cash values between the indexed and fixed accounts, and ultimately relinquished the policies or allowed them to expire. Pacific Life claimed that the Buschs were attempting to attribute the unfavorable financial results to the IUL product rather than acknowledging their own decisions and actions.

To elaborate, an Indexed Universal Life insurance policy is a hybrid product combining life insurance protection with a cash value component that is linked to the performance of a stock market index but typically includes safeguards against market downturns.

When Kyle Busch filed his suit last year, he indicated that he had been informed that a payment of $1 million annually over five years would enable him to withdraw $800,000 each year upon reaching age 52. Busch reported that upon receiving a notice for a sixth premium payment, he raised concerns and discovered that nearly all his invested capital had been exhausted.

Pacific Life countered by noting that the Buschs recognized the terms of the policies through signed acknowledgments. The insurer further argued that the claims for breach of fiduciary duty and negligent misrepresentation are barred by the statute of limitations, as these claims were filed more than three years after the first policies were purchased.

The company emphasized in its legal filing that plaintiffs cannot circumvent the statute of limitations by consciously ignoring facts that would have been evident with reasonable attention. Pacific Life stated, "A plaintiff cannot avoid the statute of limitations by remaining ‘willfully blind’: A man should not be allowed to close his eyes to the facts readily observable by ordinary attention, and maintain for his own advantage the position of ignorance. This principle prevents careless parties from indefinitely extending their right to seek recovery."

Additionally, Pacific Life asserted that all allegations of misrepresentation are false because the Buschs provided "express, repeated disclosures" that confirmed their understanding of the products. Each of the five policies was accompanied by a cover letter with a clearly visible message in bold, capitalized letters instructing recipients to "READ YOUR POLICY CAREFULLY." The policies also afforded a 20-day cancellation period during which premiums were refundable.

The insurer confirmed that both Kyle and Samantha Busch signed documents certifying receipt of the policies and acknowledging their obligation to review them attentively.

Within the lawsuit, the Buschs also named insurance agent Rodney A. Smith, alleging that he directed them into a product that was high-risk and unsustainable, charging an upfront commission of 35% that the couple contend they were unaware of.