The surge of artificial intelligence (AI) related activity in cloud computing and data centers has created an unprecedented demand for certain types of memory chips, specifically RAM (random access memory). This rising demand is already leading to supply shortages that are starting to impact prices across various technology products reliant on these components.

Avril Wu, senior research vice president at TrendForce, a consultancy based in Taiwan specializing in computer component markets, emphasized the urgency consumers face. "I keep telling everybody that if you want a device, you buy it now," she remarked, noting her own recent purchase of an iPhone 17 as an example.

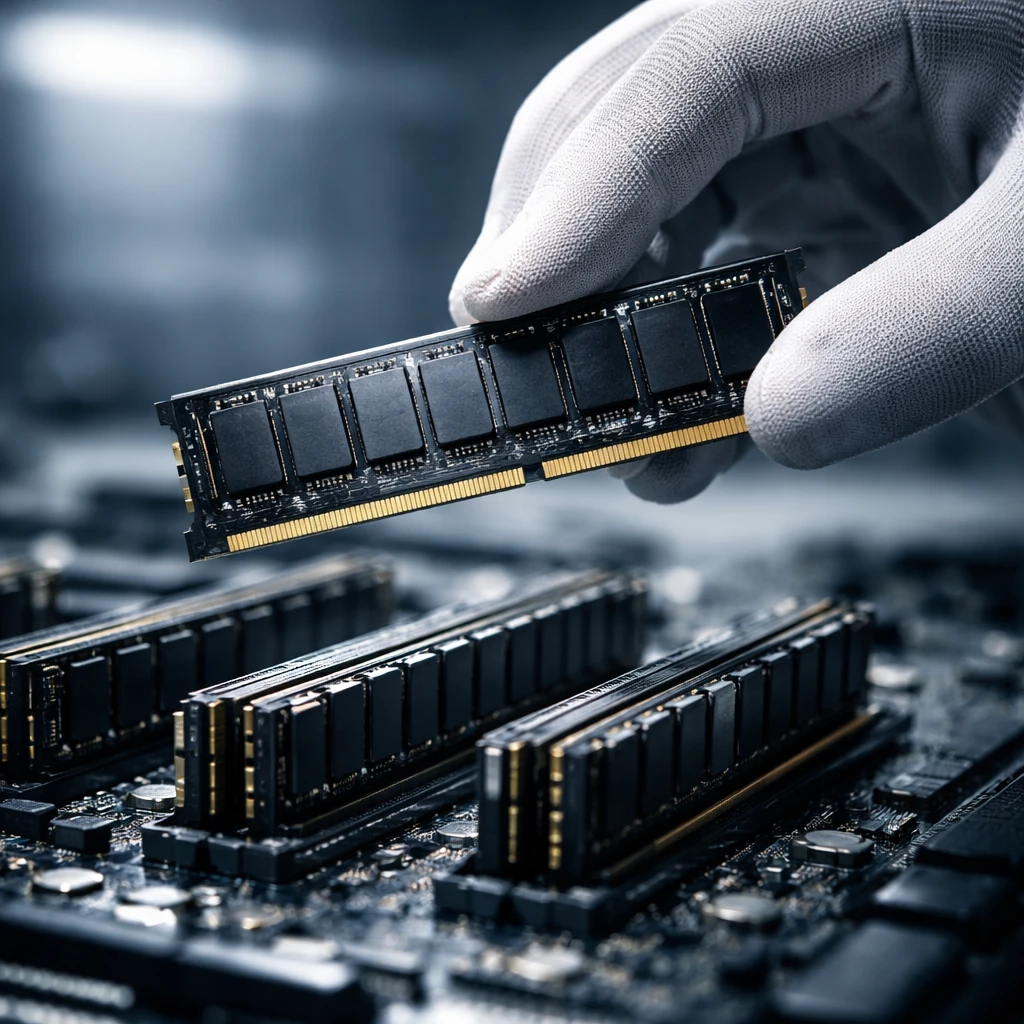

Memory chips like RAM are fundamental to the smooth operation of devices such as smartphones, computers, and gaming consoles. They permit functions like operating multiple browser tabs simultaneously and enabling uninterrupted video playback. The current imbalance between supply and demand is causing significant price pressure on these essential components.

TrendForce data reviewed by Wu indicates that demand for RAM chips outpaces supply by roughly 10%, and this gap is rapidly widening. Manufacturers are now having to pay substantially more to procure these chips on a monthly basis. Wu noted that in the latest quarter, the cost of the most prevalent type of RAM, dynamic random access memory (DRAM), has escalated by approximately 50% compared to the previous quarter. Urgent procurement efforts—requiring faster delivery—have driven prices even higher, sometimes to two or three times the base cost.

Looking ahead, Wu projects that DRAM prices will climb an additional 40% in the coming quarter, with no anticipated decline through 2026. This sustained price elevation reflects the fundamental shifts in demand driven by AI workloads.

AI systems rely heavily on vast amounts of memory to complement their advanced graphics processing unit (GPU) microprocessors used in training and executing AI models. Sanchit Vir Gogia, CEO of Greyhound Research, a technology advisory firm, underscored this point: "AI workloads are built around memory."

The substantial investment by AI companies constructing data centers rapidly around the globe further intensifies chip demand. Gogia explained that this is not a typical cyclical surge but a transformative change in the nature of demand. AI-specific computing tasks require extensive, continuous memory resources with high bandwidth and proximity to computing elements. This demand cannot be reduced without sacrificing system performance.

Among the leading suppliers benefiting from this trend is Idaho-based Micron Technology, one of the world's foremost manufacturers of RAM chips. The company reported quarterly earnings that exceeded expectations, fueled by rising memory chip prices. Micron's CEO, Sanjay Mehrotra, highlighted the robust market environment, stating on a webcast following the earnings release, "We believe that the aggregate industry supply will remain substantially short of the demand for the foreseeable future."

In response to lucrative AI-related opportunities, chipmakers like Micron have redirected production capacity toward high-end memory chips suited to AI applications. This strategic shift results in fewer memory chips being available for other market segments, including personal computers, mobile phones, gaming consoles, and consumer electronics such as televisions.

This redistribution exacerbates cost pressures across several technology product categories. Jeff Clarke, Chief Operating Officer of Dell Technologies, acknowledged on an earnings call dated November 25 that increased component costs stemming from these supply dynamics are likely to be passed on to consumers, stating, "I don't see how this will certainly not make its way into the customer base."

Analysts agree that there is no immediate remedy to the memory supply crunch. Wu pointed out a critical bottleneck in chip manufacturing capacity. She highlighted that by the end of 2026, existing fabrication plants will reach their maximum expansion capabilities, limiting prospects for increasing supply in the near term.

The next anticipated boost to production capacity is a new manufacturing facility under construction by Micron in Idaho. The company expects this factory to be operational by 2027. Until this new production line comes online, memory chip suppliers are expected to maintain a pricing strategy aligned with the ongoing tight supply-demand balance.

In sum, the AI-driven demand surge is reshaping the RAM chip market and, by extension, the pricing landscape for technology products reliant on this essential component. Consumers and manufacturers alike face a period of elevated costs and constrained supply, with industry participants preparing for sustained challenges over the next several years.