Articles

Building and Using Mental Models to Improve Stock Trading Decisions

For beginner and intermediate traders aiming to enhance reasoning, reduce biases, and improve decision-making with practical mental frameworks

Mental models are simple, fundamental frameworks that help traders make sense of complex stock market scenarios and improve decision quality. This gui...

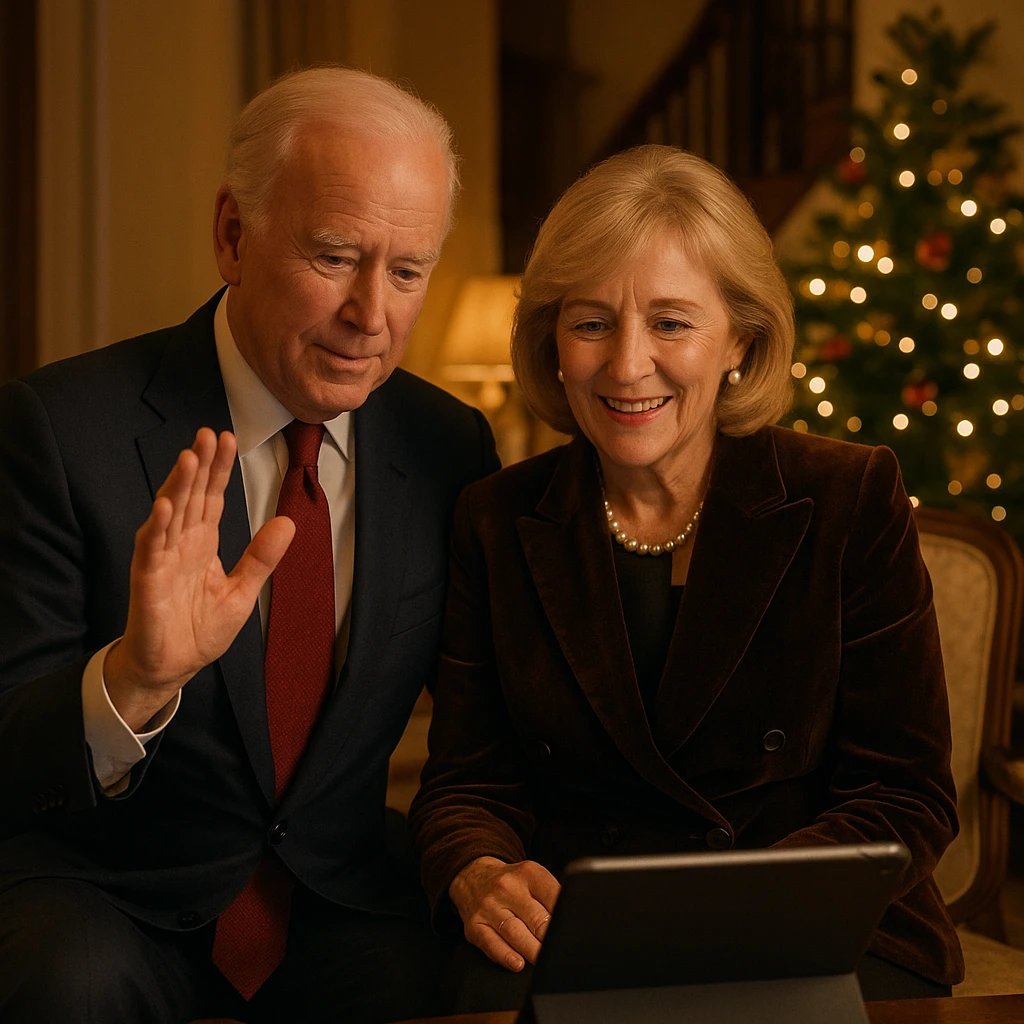

Trump Engages Children in NORAD Santa Tracker Call from Mar-a-Lago

President and First Lady Bring Festive Cheer While Touching on Political Themes During Annual Holiday Tradition

President Donald Trump and First Lady Melania Trump participated in the North American Aerospace Defense Command's (NORAD) yearly Christmas Eve tradit...

Using Price Action Trading to Make Clearer Stock Market Decisions: A Practical Guide for Beginners and Intermediate Traders

For traders wanting to use pure price movement analysis to identify high-probability trade setups without relying on lagging indicators

Price action trading focuses on interpreting raw price movements—opens, closes, highs, and lows—to make objective and timely trading decisions. Th...

Understanding Market Breadth Indicators: A Practical Guide to Gauging Stock Market Health and Momentum

For beginner and intermediate traders who want to learn how to use market breadth indicators to enhance timing and risk management in stock trading

Market breadth indicators provide an overview of the overall market's strength or weakness by analyzing the number of advancing and declining stocks. ...

The Hidden Barriers in Blue-Collar Apprenticeships: One Electrician's Struggle Reveals a Backlogged and Insular Trade

Despite Popular Beliefs, Entry Into Skilled Trades Like Electrical Work Remains Difficult Due to Gatekeeping, Nepotism, and Lengthy Union Pipelines

While common perception suggests that skilled trades, such as electrical work, are readily accessible with abundant opportunities for apprentices, a f...

Utilizing Dividend Investing in Stock Trading: A Practical Guide for Building Income and Stability

For beginner and intermediate traders looking to understand dividend investing strategies to enhance portfolio income and reduce volatility

Dividend investing focuses on selecting stocks that provide regular income through dividend payments in addition to potential capital appreciation. Th...

Practical Guide to Trading with Bollinger Bands: Enhancing Timing and Risk Management

For beginner and intermediate traders learning how to apply Bollinger Bands effectively for better entry, exit, and volatility assessment in stock trading

Bollinger Bands are a powerful technical analysis tool that uses price volatility to signal potential trading opportunities. This guide breaks down ho...

Leveraging Stock Beta for Smarter Risk and Portfolio Management

A practical guide for beginner and intermediate traders to understand, calculate, and apply beta to make informed trading and diversification decisions

Beta is a measure of a stock's sensitivity to market movements and an essential tool to gauge risk relative to the overall market. This guide explains...

Mastering Sector Rotation: A Practical Guide to Diversifying Stock Trading Strategies by Market Cycles

For beginner and intermediate traders seeking to enhance portfolio resilience and timing by understanding sector rotation dynamics

Sector rotation is the practice of moving investments between different industry sectors to align with economic cycles and market trends. This guide e...

Using Relative Strength Index (RSI) Effectively in Stock Trading: A Practical Guide for Beginners and Intermediate Traders

Learn how to interpret and apply the RSI indicator to identify potential overbought or oversold conditions and enhance your trade timing

The Relative Strength Index (RSI) is a popular momentum indicator that measures the speed and change of price movements to help traders identify poten...

Understanding and Managing Slippage in Stock Trading: A Practical Guide to Minimizing Hidden Costs

For beginner and intermediate traders seeking to identify, anticipate, and reduce slippage to improve trade execution and protect capital

Slippage—the difference between an expected trade price and the actual execution price—can erode trading profits and increase risk without traders...

Building Confidence with Paper Trading: A Practical Guide for Beginner and Intermediate Stock Traders

For traders seeking hands-on practice and skill-building without financial risk, learn how to use paper trading effectively to boost confidence and improve trading skills

Paper trading, or simulated trading, allows you to practice stock market strategies in a risk-free environment using virtual money. This guide explain...