Education

Guides and explainers: how to read markets, indicators, and financials.

Constructing and Trading Stock Market Support and Resistance Levels Effectively

For beginner and intermediate traders learning how to identify, interpret, and use support and resistance levels to improve entry, exit, and risk management decisions

Support and resistance levels act as critical price points where stocks tend to pause, reverse, or accelerate, offering traders valuable clues for tim...

Stock Market Seasonal Patterns: How to Identify and Trade Recurring Price Trends

For beginner and intermediate traders learning to recognize and apply seasonal trends in stock markets to enhance timing and risk management

Seasonal patterns in stock markets refer to regular and recurring price tendencies linked to specific times of the year, months, or trading days. This...

Leveraging Trading Volume Profile: How to Use Volume Distribution for Smarter Stock Market Decisions

For beginner and intermediate traders learning to analyze volume distribution within price ranges to enhance trade entry, exit, and risk management

Volume Profile is a powerful analytical tool that reveals how trading volume is distributed across price levels over a selected period, providing uniq...

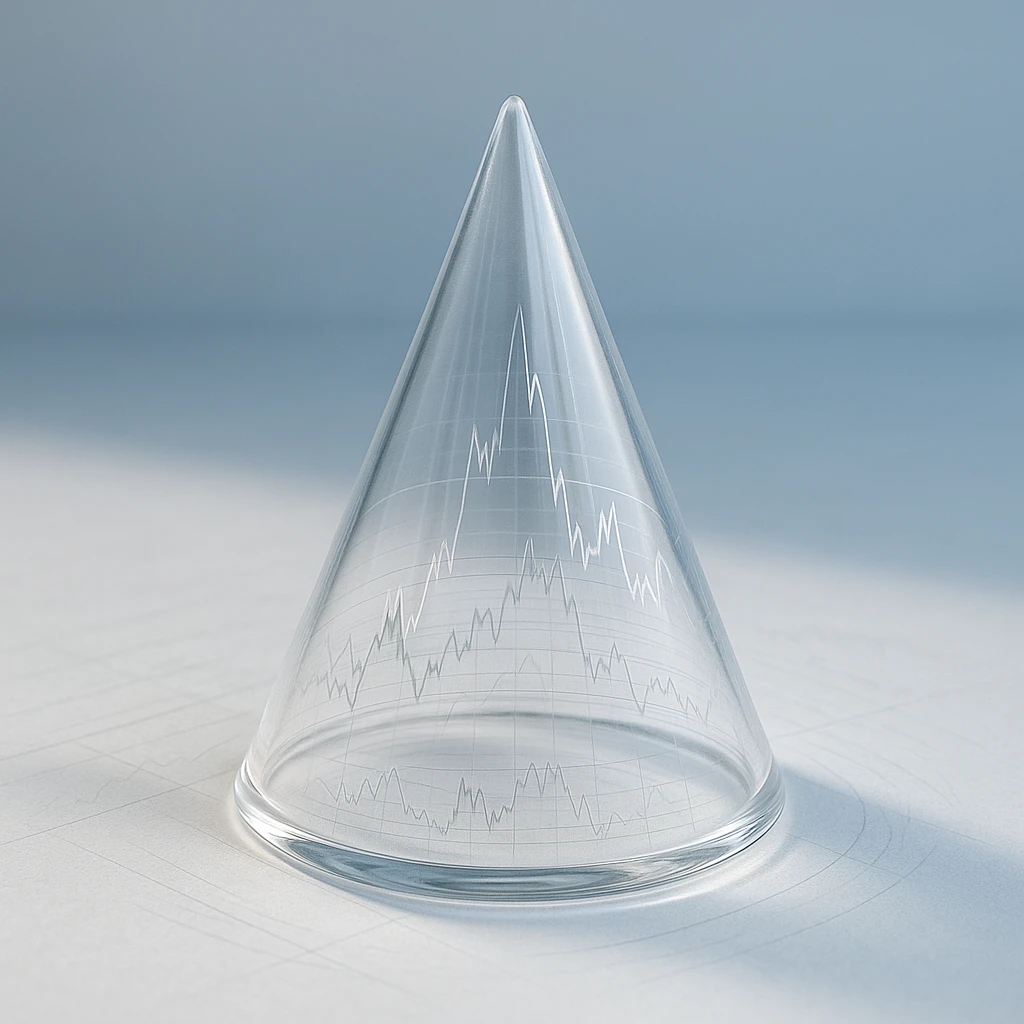

How to Effectively Use Volatility Cones for Smarter Stock Trading Decisions

For beginner and intermediate traders seeking to understand, build, and apply volatility cones to improve risk management and timing

Volatility cones are visual tools that provide statistical context for a stock's current volatility compared to its historical range. This guide expla...

Mastering Trade Scaling: How to Enter and Exit Stock Positions Gradually to Improve Risk and Execution

For beginner and intermediate stock traders learning actionable frameworks to scale into and out of trades confidently and effectively

Scaling trades, the practice of entering or exiting stock positions in multiple smaller portions rather than all at once, can help traders manage risk...

Mastering Stock Trade Scaling: Step-by-Step Methods to Enter and Exit Positions Gradually for Better Risk and Emotion Control

For beginner and intermediate stock traders learning how to scale into and out of positions to improve risk management, execution, and trading psychology

Scaling trades means breaking your stock entries and exits into smaller portions rather than trading all at once. This detailed guide teaches you why ...

Leveraging Stock Market Sentiment Indicators for Informed Trading Decisions

A clear guide for beginner and intermediate traders to understand, interpret, and apply sentiment indicators to improve trade timing and risk management

Market sentiment reflects the overall attitude of investors toward stocks or the market, often driving price movements beyond fundamental values. This...

Mastering Stock Trading Alerts: How to Set Up, Manage, and Act on Alerts for Smarter Decisions

For beginner and intermediate traders who want to use trading alerts effectively to improve timing, discipline, and risk management

Trading alerts help you focus on key market movements without needing to watch the screen constantly. This guide teaches you how to choose the right ...

Building and Using Stock Trading Watchlists: A Step-by-Step Approach to Focus and Trading Success

For beginner and intermediate traders learning how to create, organize, and effectively use watchlists to streamline trade selection and improve decision-making

Creating and maintaining a stock trading watchlist is a foundational skill that helps traders manage information overload and focus on high-potential ...

Building a Stock Trading Watchlist: A Step-by-Step Guide to Organizing and Prioritizing Trading Opportunities

For beginner and intermediate traders learning how to create and use watchlists to focus on high-potential stock trades and improve decision-making

An effective stock trading watchlist helps you manage the overwhelming number of available stocks and streamlines your trading process. This guide tea...

Building and Using Trading Checklists: Your Blueprint for Consistent and Disciplined Stock Market Decisions

For beginner and intermediate traders learning how to create effective checklists to improve decision-making, reduce errors, and manage risk

Trading checklists provide critical structure and discipline in the complex, fast-paced environment of stock trading. This detailed guide explains why...

Effective Use of Trading Alerts: How to Stay Prepared and Make Timely Stock Market Decisions

For beginner and intermediate traders learning to set, manage, and act on trading alerts for improved timing, discipline, and risk control

Trading alerts help stock traders focus on key market events without constant screen monitoring, enabling better timing and more disciplined decisions...