The US economy continues to demonstrate notable growth, as highlighted by recent quarterly GDP figures. However, this economic uptrend has not translated into corresponding increases in employment, revealing a significant disconnect between overall growth and the labor market's performance.

Traditionally, periods of vigorous economic expansion align with heightened hiring activity and rising personal income levels, fostering sustained consumer spending. Contrary to this norm, 2026 has seen consumer spending driving economic growth while job creation remains restrained – a phenomenon described by KPMG's chief economist Diane Swonk as a 'decoupling' of growth and labor market outcomes.

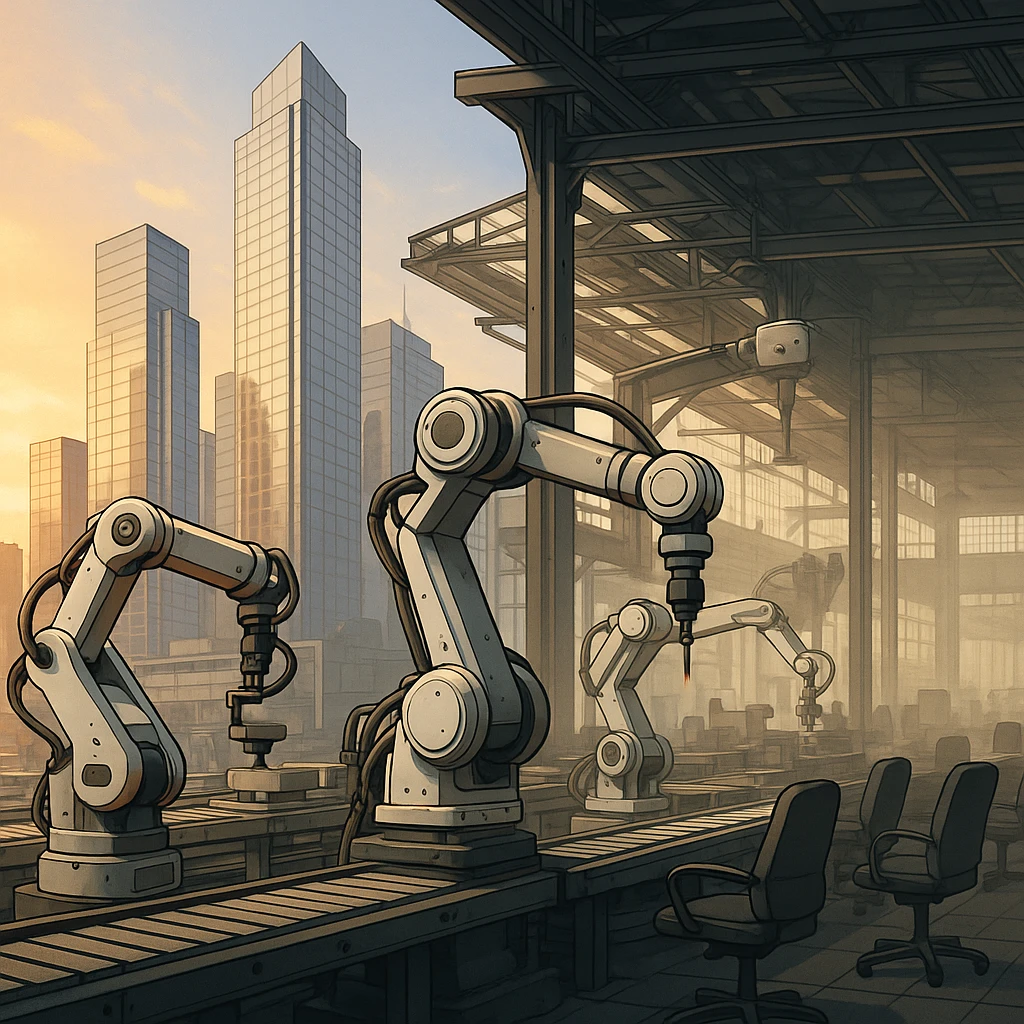

This distinctive pattern, often characterized as a 'jobless boom,' features robust capital flow within the economy but a lack of proportional job growth. A critical factor underlying this trend is the extensive investment in artificial intelligence (AI) made by large corporations. These entities, including some leading firms in the technology and retail sectors, have been pivotal in generating economic expansion this year, despite simultaneously implementing white-collar workforce reductions.

Some of these prominent companies have reported substantial profit increases, adhering to a corporate strategy summarized by the adage to 'do more with less.' This approach involves optimizing productivity with fewer employees, supported by AI-driven efficiencies, and has influenced staffing decisions across various industries.

As Diane Swonk elaborated, many firms initially expanded their workforces aggressively during prior hiring surges but are now realigning employee numbers through attrition and layoffs to better match current demand levels. Additionally, in response to profit margin pressures caused by tariffs, some companies have resorted to workforce reductions and hiring freezes as cost management measures.

Economists remain challenged in fully explaining the mechanisms driving this unusual combination of strong economic growth and stagnant employment. While layoffs have incrementally increased throughout the year, overall severance rates remain relatively modest, with significant job cuts concentrated primarily in prominent corporate and technology firms such as Amazon, Microsoft, Meta, Google, and Tesla.

Experiences reported by numerous white-collar job seekers highlight the challenging employment landscape. Many describe the difficulty of securing new positions, noting prolonged periods without interviews despite extensive applications, while current employees have generally been reluctant to leave existing roles amid market uncertainties.

Complicating the labor market scenario, consumers exhibited no growth in income during the last quarter. Nonetheless, spending remained resilient—even in the face of persistent inflation above the Federal Reserve's 2% target and ongoing tariff uncertainties. A considerable portion of the spending increase originated from expenditures on healthcare and medical services, particularly hospital and nursing care costs, marking the highest level of healthcare service spending since 2022 when the Omicron COVID-19 surge affected the nation.

This spending pattern suggests that although affluent consumers contributed to the rise in expenditures, broader consumer confidence may not have markedly improved. Consumer sentiment indices remain near historical lows, reflecting widespread caution about economic prospects amid tariff ambiguity and labor market difficulties.

The unemployment rate stands at 4.6%, the highest since 2021, with overall job growth progressing slowly. Interviews with diverse job seekers reveal frustrations linked to perceived age discrimination, complex hiring procedures, intense competition for limited openings, and AI technologies potentially filtering applications. Reports indicate that some candidates applied for thousands of jobs without securing interviews, while others have spent over a year pursuing opportunities, often accepting offers with reduced compensation relative to prior roles.

Looking ahead, the year 2026 might see AI investments begin to yield measurable returns, potentially reinforcing the existing jobless growth trend. Business Insider's Dan DeFrancesco emphasized the need to demonstrate tangible outcomes from substantial AI expenditures by major technology firms planning increased budgets next year.

Should these investments succeed in boosting productivity without expanding payrolls, the restrained hiring environment may persist or intensify. The notable 4.3% GDP rise in the third quarter, the highest since late 2023, points to positive economic momentum, a development that former President Donald Trump credited to his economic policies.

Nevertheless, concerns persist among the workforce regarding employment stability and opportunities, especially as companies justify layoffs by citing efficiency improvements facilitated by AI. The United States continues to operate with fewer jobs than pre-pandemic levels, and Federal Reserve Chair Jerome Powell has recently suggested that the subdued improvements in employment numbers may not fully capture underlying labor market dynamics.