The Trump administration and certain sectors of Wall Street are currently endorsing an economic strategy sometimes described as "running it hot," which envisions an unusual economic scenario: achieving rapid growth alongside restrained inflation. Conventionally, swift expansion tends to increase demand, pushing prices upward, yet proponents of this strategy argue that advancements in artificial intelligence (AI) could replicate, or even surpass, the productivity surge witnessed during the 1990s internet era. According to this perspective, AI integration across industries could enhance productivity, permitting businesses to scale effectively and spurring stock market gains without triggering significant inflation.

This concept draws partial inspiration from the 1990s, when networked computing helped fuel vigorous economic growth coinciding with price stability. Nonetheless, this historical comparison is made with caution, considering the distinct economic context today. Factors such as post-Cold War realignments, deregulation, and globalization played crucial roles back then; in contrast, today’s macroeconomic environment presents new dynamics.

On a recent CNBC appearance, Kevin Hassett, economic advisor to the Trump administration, advocated for the Federal Reserve's next chairperson to follow a policy reminiscent of Alan Greenspan's tenure by maintaining low interest rates. Hassett highlighted strong U.S. economic growth accompanied by subdued inflation, attributing this to current productivity improvements driven by AI technologies and data center expansions. He asserted that the current economic landscape resembles the prosperous climate of the 1990s in terms of growth metrics and underlying productivity trends.

Despite these optimistic assertions, caution is warranted. The comparison to the 1990s growth model has become increasingly popular, fueled by enthusiasm around AI and reminiscent of past technological exuberance. However, significant differences exist in today's economic realities, highlighted by disparities in wealth distribution and differing sources of economic momentum. The headline GDP growth rate, recently recorded at an annualized 4.4% for the third quarter, mirrors growth levels seen during the mid-1990s, yet this aggregate figure conceals divergent experiences within the economy.

Critically, whereas the 1990s boom was broadly supported by consumption across various income groups, the current expansion appears predominantly driven by the top 20% of earners, who now account for approximately 59% of consumer spending. This phenomenon illustrates a "K-shaped" economy, where wealth and prosperity concentrate among higher earners, while lower-income groups face intensifying challenges. Rising costs of essential goods such as housing and food exacerbate difficulties for many households, even as segments of the economy flourish.

Supporting this current economic posture are two primary factors: the spending power of affluent consumers and substantial corporate investments in AI technology. These elements are interconnected, as many of the wealthiest Americans have gained financial strength partly through equity market gains fueled by enthusiasm for AI-related sectors over the past several years.

While the "run it hot" approach—focused on leveraging AI to sustain growth with controlled inflation—holds theoretical promise, significant uncertainties and risks remain. Firstly, the successful realization of this vision depends heavily on widespread adoption and effective utilization of AI technologies by businesses and consumers alike. Microsoft’s CEO Satya Nadella recently emphasized at the Davos summit that the transformative potential of AI rests upon an expanded user base. Without broad usage, the anticipated productivity enhancements may fall short, undermining the strategy’s underpinnings.

Secondly, the existing economic divide means that positive macroeconomic indicators do not equate to improved conditions for the majority of Americans. Low unemployment rates and strong stock market performance may mask financial strain for many, especially as essential goods become less affordable. Political ramifications loom, as economic gains concentrated among the wealthiest may fail to translate into wider public contentment, risking social and electoral consequences.

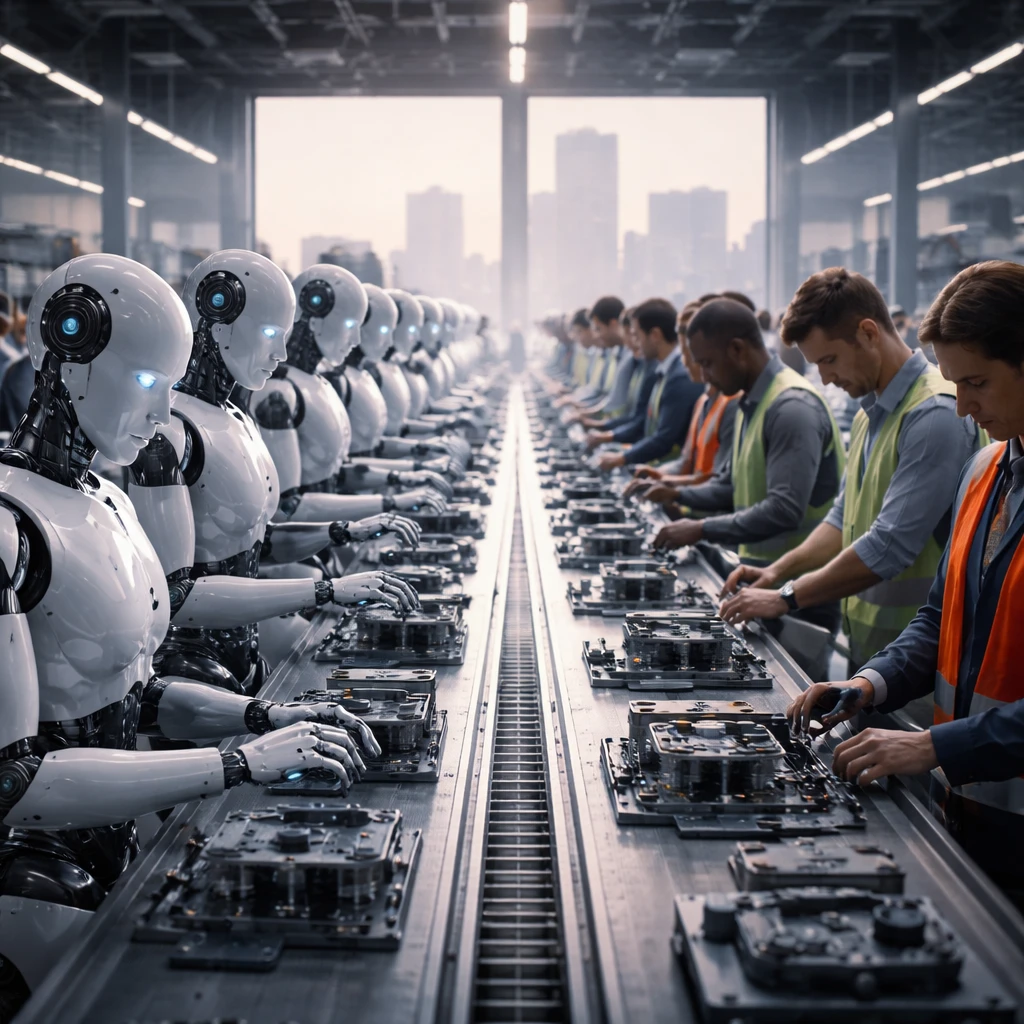

Moreover, if AI delivers on promises to significantly optimize labor processes, potential mass layoffs could ensue as software substitutes for human workers. Should such job disruptions occur concurrently with already low interest rates, the Federal Reserve would possess limited monetary policy tools to counteract resultant economic downturns or labor market shocks.

In summation, while proponents argue that policies aimed at "running the economy hot" could foster substantial GDP growth and market gains, they must reckon with underlying societal inequities and technological adoption challenges. As Mike O’Rourke, Chief Market Strategist at JonesTrading, remarked, economic growth disconnected from broad-based improvements risks political backlash if "Main Street" participants feel excluded from prosperity.