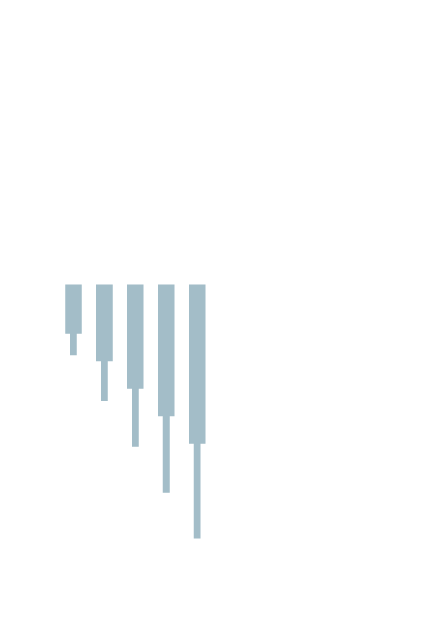

The early week trading session in U.S. equities witnessed a mixed performance, with the Nasdaq Composite indexing a notable advance of approximately 100 points amid fluctuating market sentiment. Central to Monday’s upward momentum was the pronounced rally in Valaris Ltd’s stock, which surged markedly following the declaration of its impending acquisition by Transocean Ltd. This transaction, valued at an estimated $5.8 billion, is structured as an all-stock deal wherein holders of Valaris shares will receive 15.235 shares of Transocean stock in exchange for each Valaris share they own. The announcement sparked a robust 21.8% increase in Valaris's share price, which closed at $76.02 during the session.

Valaris’s acquisition announcement highlights a strategic consolidation within the offshore drilling sector, reflecting the companies’ efforts to strengthen their operational and market positions. This agreement, pending completion, represents a significant valuation benchmark and charts a course for integrated capabilities under Transocean’s leadership.

Alongside Valaris, other substantial equities reported meaningful gains throughout Monday's trading. Nexstar Media Group Inc. shares rose by 12.4%, closing at $248.70. This advance followed a political endorsement from former President Donald Trump favoring Nexstar’s proposed $6.2 billion acquisition of Tegna Inc., a move previously met with some resistance. The endorsement potentially clears a path for smoother regulatory review and shareholder approval of the transaction.

Intuitive Machines Inc. experienced a share price increase of 12.2%, finishing at $19.66. Similarly, Terawulf Inc.’s shares spiked by 12.1% to $16.03, ahead of its scheduled fourth-quarter earnings conference call and webcast planned for late February, signaling investor anticipation around its upcoming financial disclosures.

Electric vehicle materials producer Elevra Lithium Limited saw its shares appreciate 11.8%, settling at $51.34, while Bullish, a financial services platform, and Gold.com Inc., an online gold bullion retailer, climbed by 11.6% and 11.4% to $30.62 and $61.65, respectively. These movements indicate strong investor interest in diverse growth areas, including commodities, digital finance, and emerging energy resource markets.

Further notable market activity includes AXT Inc.’s 10.5% jump to $26.58 and AppLovin Corp.’s 10.3% rise to $448.66, both of which underscore robust performance within technology-related sectors. WW International Inc., recognized for weight management services, also advanced 10.2% to $24.13.

Oracle Corporation made significant headway with a 9.9% stock increase to $156.99 following an analyst upgrade. DA Davidson’s Gil Luria revised Oracle's rating from Neutral to Buy while maintaining a $180 price target, reflecting growing confidence in Oracle's strategic positioning within the enterprise software landscape.

Unity Software Inc. recorded a 9.4% gain, closing at $27.45. Wearable health monitoring company Zepp Health Corp. also observed share appreciation by 7.9% to $19.08. Additionally, Roblox Corporation’s shares climbed 7.6% to $71.46, buoyed by a Roth Capital analysts upgrading its rating from Neutral to Buy and raising the price target from $78 to $84. This reflects heightened optimism about Roblox’s growth trajectory amid the expanding digital entertainment economy.

Consumer goods giant Kroger Co. advanced 7% to $72.24 following its announcement appointing Greg Foran as the new Chief Executive Officer, signaling potential strategic shifts and renewed executive vision.

The overall market movements on Monday were characterized by selective surges across various sectors, driven by a mix of strategic corporate events, endorsements, analyst assessments, and leadership appointments. These factors collectively contributed to a cautiously optimistic market environment, despite ongoing broader economic uncertainties.

Investors continue to monitor these developments for indications of longer-term trends in corporate consolidation, sectoral growth potential, and evolving competitive dynamics.