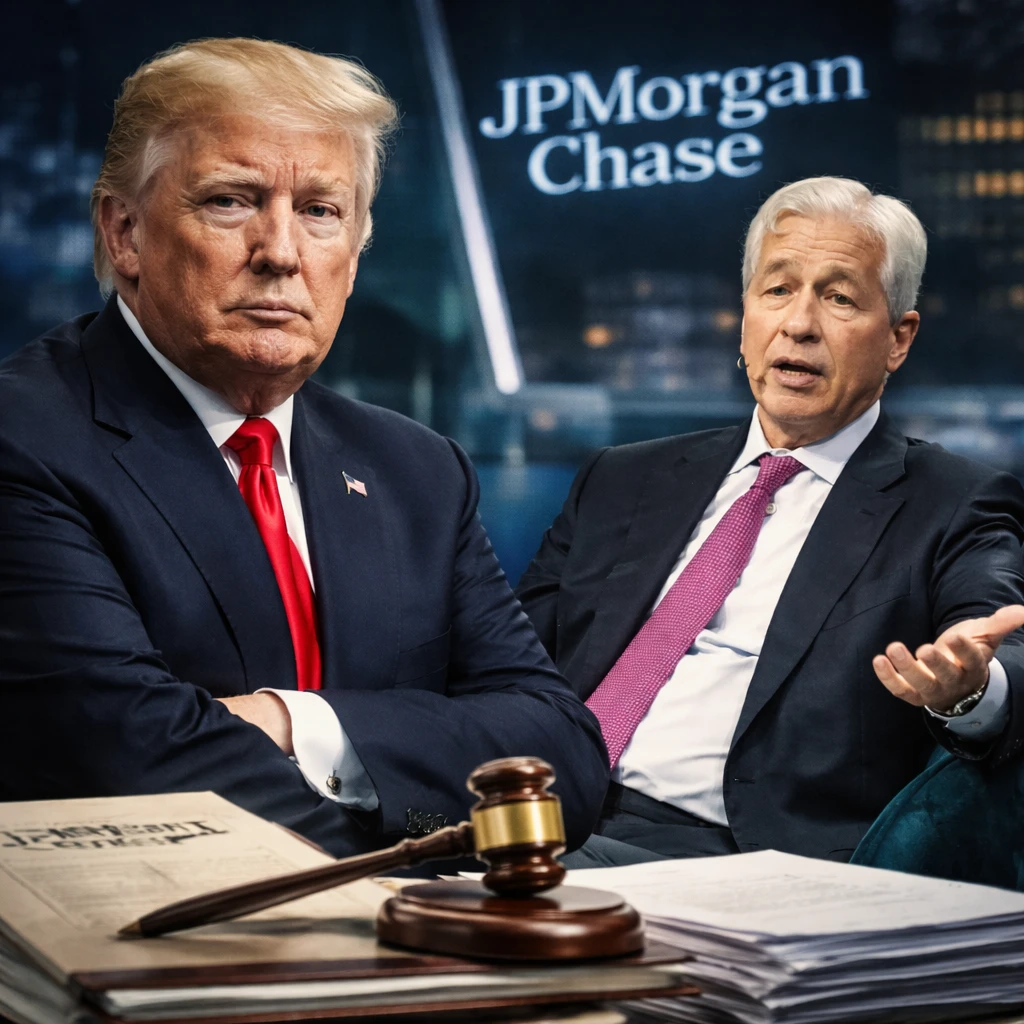

Donald Trump has taken legal action against major financial institution JPMorgan Chase and its chief executive, Jamie Dimon, claiming $5 billion in damages for allegedly terminating banking relationships with him and his associated businesses due to political considerations following his departure from office in January 2021.

The suit, filed in Florida's Miami-Dade County court, alleges that in February 2021, JPMorgan summarily closed several accounts associated with Trump on merely 60 days' notice, without offering any rationale. According to the complaint, this action disconnected Trump and his enterprises from access to substantial financial resources, interfering with their operational continuity and compelling them to urgently establish accounts with other banks.

It is asserted in the lawsuit that JPMorgan and Dimon made these decisions based on the belief that prevailing political sentiments favored such measures. The practice described, known as debanking, involves a financial institution closing a customer's accounts or refusing service, which can also encompass withholding lending or other financial services.

Although debanking was once a relatively niche issue within financial services, it has gained prominence amidst political debates, particularly as conservative figures have alleged that banks discriminate against them and related interests. The term gained national attention during the Obama administration through controversies like "Operation Choke Point," which targeted certain industries such as firearm retailers and payday lenders.

Furthermore, following the Capitol breach on January 6, 2021, Trump and other conservatives have contended that banks have preemptively severed financial ties citing "reputational risk" as justification. Measures have since been introduced during Trump's recent tenure to prevent regulatory allowance for banks to deny customers services based solely on such reputational concerns.

Legal representatives for Trump argue that JPMorgan's conduct exemplifies a pervasive, covert banking industry practice aimed at influencing public political alignment by restricting access to financial infrastructure.

Beyond claims of politically motivated closed accounts, the lawsuit brings accusations of trade libel against JPMorgan and charges that CEO Dimon violated Florida's Unfair and Deceptive Trade Practices Act. JPMorgan responded by expressing regret over the litigation but firmly denied any political motivation in its actions. A spokesperson emphasized that account closure decisions are driven by concerns over legal or regulatory risk, not political or religious affiliations.

This case highlights the uncertainties and tensions arising at the intersection of political change and banking sector risk management practices.