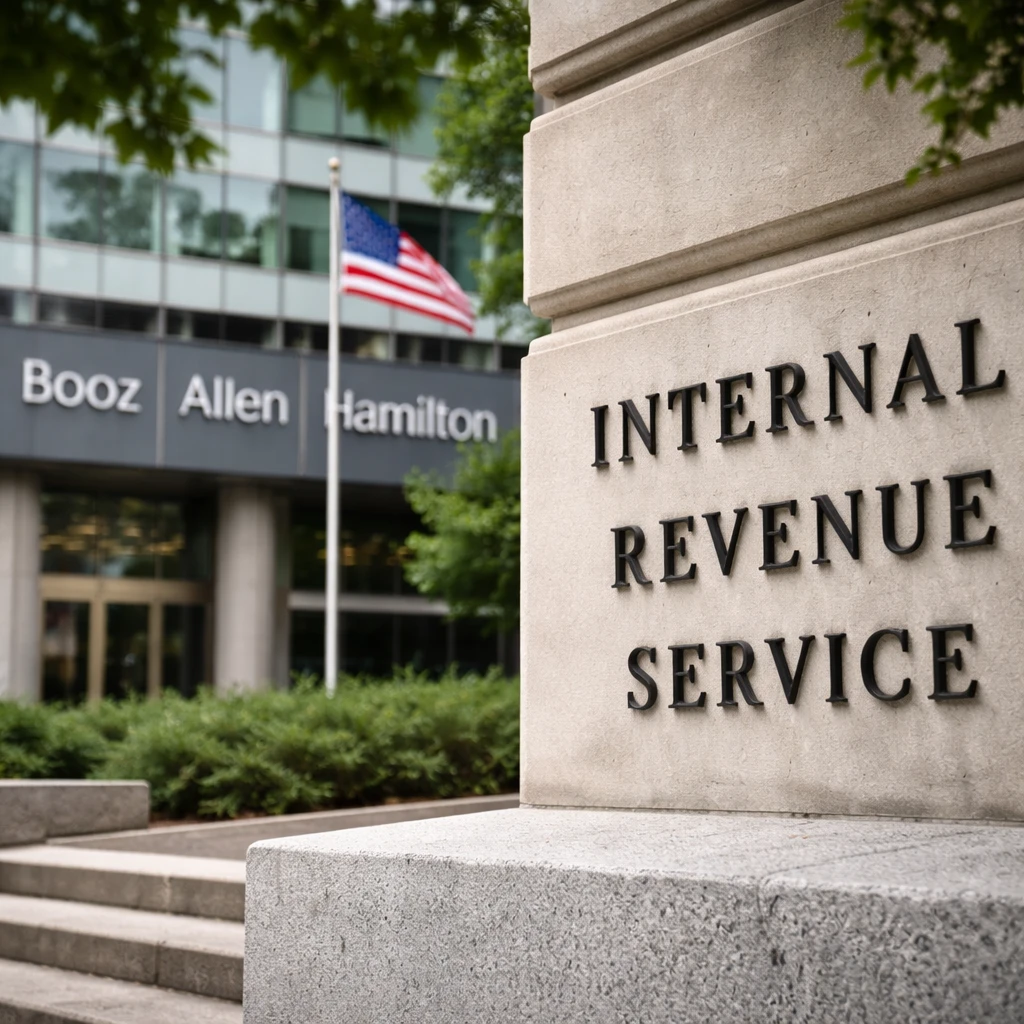

In a decisive response to a recent breach of confidential tax information, the U.S. Treasury Department has ended its contracts with Booz Allen Hamilton. This step comes after Charles Edward Littlejohn, a former contractor connected to the firm, was sentenced to five years in prison for leaking tax documents concerning several of the nation's richest citizens, including then-President Donald Trump.

The leak, which unfolded over the period from 2018 to 2020, involved disclosures to prominent news organizations such as The New York Times and ProPublica. Prosecutors described the scale and nature of these leaks as "unparalleled" in the IRS’s history. Court filings further revealed that Littlejohn had intentionally sought a contracting role to access and extract Trump’s tax returns by devising careful methods to avoid detection within the IRS.

Booz Allen Hamilton, a leading defense and national security technology provider headquartered in McLean, Virginia, currently holds numerous contracts with various government bodies, including the Department of Defense, Homeland Security, and intelligence agencies. Despite losing Treasury contracts—31 agreements valued at $4.8 million annually and with total obligations of $21 million—the company maintains a sizable presence across federal agencies.

Treasury Secretary Scott Bessent criticized Booz Allen for failing to implement adequate security measures to protect sensitive taxpayer data accessed through contracts with the IRS. In response, Booz Allen spokesperson Brian P. Hale emphasized the firm's repudiation of Littlejohn’s illegal actions and its zero tolerance policy for such violations. According to Hale, the company fully cooperated with the government throughout the investigation, which culminated in Littlejohn's prosecution, and Booz Allen looks forward to ongoing discussions with Treasury regarding the situation.

Importantly, Booz Allen stated that it does not store taxpayer information on its own systems and lacks oversight capabilities over government network activity. Market reactions followed the announcement, with Booz Allen shares dropping from $102 per share on Friday to $91 and continuing to decline on Monday. The firm’s recent SEC filing cited risks including any damage to relationships with the federal government or damage to the firm’s professional reputation, especially due to negative publicity surrounding government contractors.